A Rebalancing Guide: Part One

MAIN TAKEAWAY

Rebalancing is a common portfolio mechanism designed to manage risk, and usually results in better risk-adjusted returns compared to not rebalancing.

KEY TALKING POINTS

Rebalancing benefits investors by preventing a portfolio from becoming too aggressive or too conservative.

The process involves trimming investments that have performed well and reinvesting the proceeds into investments that haven’t.

Rebalancing can be executed at pre-determined frequencies or when specific thresholds are breached.

Systematic rebalancing removes emotion & guesswork from trading decisions.

WHY REBALANCING MATTERS

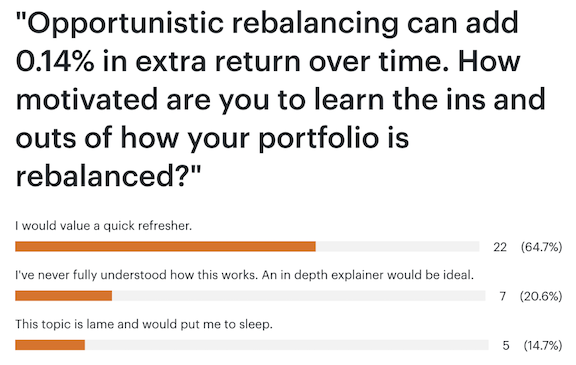

Rebalancing was the #1 educational topic requested from the firm’s CLIENT SURVEY last year:

This post is Part 1 of a two-part series for the 85.3% of the firm’s clients who don’t think rebalancing is “lame”.

In Part 2, we’ll look at the published research from trusted sources to determine when investors should rebalance.

Think of this mini series as theory (Part 1) and implementation (Part 2).

HOW REBALANCING WORKS

Let’s assume a simple but effective portfolio of a few funds representing stocks (50% of the portfolio), and a few funds representing bonds (the other 50%).

Let’s also assume that after initially purchasing our funds, the stock market takes off while the bond market remains flat.

Hypothetically, let’s say we’re lazy and don’t check on the portfolio for 3 years. When we finally do, we find that our stock funds no longer represent the original 50% of the portfolio. They now represent 70% of the portfolio, meaning the bond funds represent the other 30%.

Quick side note- this would actually take a massive stock swing to grow from 50% to 70% of a portfolio in just 3 years.

Returning to our hypothetical example, let’s examine how we got here.

Due to the difference in return, stocks compounded at a faster rate than our bond funds.

This is good and bad, depending on how you look at it.

It’s good in that some of our investments appreciated.

It’s bad in that now we have a portfolio biased towards stock funds, which typically means more volatility than what we would expect from our original 50/50 portfolio.

We return to our original 50/50 allocation by selling some of the stock funds and using the proceeds to purchase shares of the bond funds.

If we didn’t rebalance, the main issue is that if we’re not comfortable with more volatility than what we originally intended, we’re more prone to panic selling during the next market decline, potentially locking in losses and missing out on subsequent gains.

The scenario I just described is by far the #1 mistake investors make.

Rebalancing helps us manage volatility by continually returning to our 50/50 target allocation, keeping volatility in check, and staying committed to our strategy when things go sideways.

A LITTLE MORE EXPLANATION

We now know that rebalancing involves selling the most appreciated shares while simultaneously buying the least appreciated shares.

So wait, we’re selling winners and buying losers. Are you sure?

Yes.

Rebalancing doesn’t mean we’re completely cashing out of the investment that got us the most return. We’re just trimming. Think of it as getting a haircut or mowing the lawn.

This trimming effect means that we’re better positioned for the eventual market rebound because we own more stock shares than we would’ve without a rebalancing strategy.

BENEFITS OF REBALANCING

First, it helps control for volatility. Behavioral finance research shows that retirees value losing less much more than celebrating equivalent gains. We refer to this as PROSPECT THEORY, measured by a “loss coefficient”.

Second, it removes the guesswork around timing trading decisions. Have you ever bought or sold a stock and wondered if you should’ve waited a bit longer, or maybe even traded sooner? The “rules” of any rebalancing system help prevent that pit from forming in your stomach.

Third, rebalancing acts as a forcing mechanism to ensure we’re consistently buying low and selling high. Remember, we’re only trimming gains. We’re not abandoning the entire investment when we rebalance.

ARE THERE ANY NEGATIVES TO REBALANCING?

I’ve always said there are no definitive rights or wrongs when making investment decisions, only tradeoffs.

The biggest tradeoff is that rebalancing reduces returns during periods of market appreciation. When stocks are on a roll, rebalancing serves as a braking mechanism.

There can also be negative tax consequences to rebalancing. Selling appreciated shares that haven’t been held for at least a year results in realizing short-term capital gains tax.

Additionally, rebalancing can conflict with a TAX LOSS HARVESTING goal by closing out loss positions too soon or creating WASH SALES if substantially identical securities are repurchased within 30 days.

Last, rebalancing may trigger additional trading costs compared to not rebalancing. However, these are typically minimal or nonexistent at most brokerage firms.

SHOULD I ADOPT A REBALANCING STRATEGY?

The short answer in most cases is yes.

In my opinion, the benefits outweigh the negative consequences as long as we’re careful with the tax implications. The good news is that we can program trading rules into our software at ALTRUIST to mitigate most, if not all, of these negative tax implications.

Now that we have a general understanding of rebalancing, a great question to ask is “How often should I rebalance”?

Answering this question will be the focus of Part 2 of this mini series. I’ll publish a summary of the research in late Q1 / early Q2, 2026.